Imagine running a small business and seeing paper profits, but still struggling to pay bills, cover salaries, or buy inventory on time. Frustrating, right? This is a common problem many entrepreneurs face when they focus only on profit and overlook cash flow.

Simply put, profit is the money you make after subtracting expenses from revenue, while cash flow is the actual movement of money in and out of your business—what you can spend right now. Understanding the difference is not just bookkeeping jargon; it’s crucial for your business’s financial health.

Without proper cash flow management, even a profitable business can face crises, miss opportunities, or run into debt. On the other hand, keeping a close eye on your cash flow statement, tracking operating cash flow, and practicing smart expense tracking can help you plan better, avoid surprises, and make smarter decisions.

Mastering cash flow management lets you see clearly how money moves, manage working capital, and forecast future needs accurately. By doing this, you can balance revenue vs. profit, stay prepared for slow months, and ensure your small business thrives even when challenges arise.

In this guide, we’ll break down the difference between cash flow vs. profit, show you practical tips for small business accounting, and provide easy strategies to improve liquidity management. By the end, you’ll understand why both cash flow and profit matter and how to use them together to grow your business with confidence.

- What is Cash Flow and Why It Matters for Small Business Owners

- Understanding Profit vs. Cash Flow: The Key Differences

- Common Cash Flow Challenges Faced by Small Businesses

- Simple Cash Flow Management Strategies Every Small Business Should Know

- How to Improve Profit Without Hurting Cash Flow

- Key Metrics and Tools for Effective Cash Flow Management

- The Role of Financial Planning in Balancing Cash Flow and Profit

- Real-Life Small Business Examples of Cash Flow vs. Profit Challenges

- Master Your Cash Flow and Profit for Business Success

What is Cash Flow and Why It Matters for Small Business Owners

Cash flow is the lifeblood of any business. Simply put, it’s the movement of money in and out of your business. While profit shows what’s left after expenses, cash flow tells you if you actually have money to pay bills, buy inventory, or cover unexpected costs.

There are three main types of cash flow:

- Operating cash flow: Money coming from your daily business activities, like sales and service payments.

- Investing cash flow: Money spent or earned from buying and selling assets, like equipment or property.

- Financing cash flow: Money from loans, investments, or paying back debts.

Understanding these types helps you plan better and keep your business running smoothly. Poor cash flow management can create serious problems, even if your business shows a healthy profit.

For example, imagine a small bakery that sells lots of cakes and makes a profit on paper. But most customers pay later, and bills for flour, rent, and salaries are due now. Without enough operating cash flow, the bakery might struggle to pay staff or buy ingredients, even though it’s “profitable.” This shows why tracking cash flow is just as important as tracking profit.

By monitoring your cash flow statement and planning, you can avoid these surprises. Effective cash flow management ensures you always know how much money is available for everyday operations, helps with financial planning, and keeps your small business healthy and ready to grow.

Understanding Profit vs. Cash Flow: The Key Differences

Many small business owners confuse profit with cash flow, but they are not the same. Profit, or net profit, is the money left after subtracting all expenses from your revenue. It shows whether your business is making money on paper. In contrast, cash flow is the actual money moving in and out of your business, telling you if you have enough cash to pay bills, salaries, or buy supplies.

A business can be profitable but still face cash flow problems. For example, imagine a small printing shop that completes a big order worth $5,000. The profit looks great, but if the client pays 30 days later, the shop might struggle to pay for ink, paper, and rent in the meantime. This is why cash flow management is essential—even profitable businesses can run into trouble without enough cash on hand.

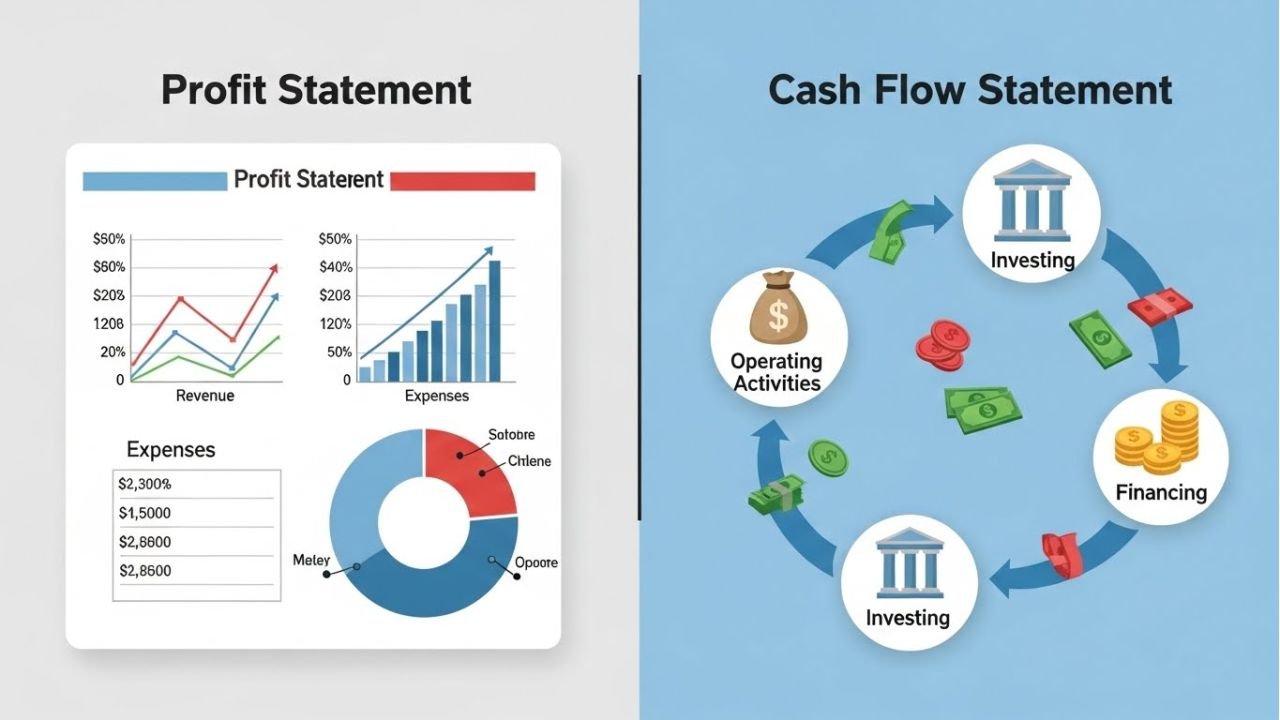

To make it clearer, think of a profit vs. cash flow statement like two different pictures of your finances. The profit statement shows your overall success over a period, while the cash flow statement shows the real-time movement of money. By comparing both, you get a complete view of your financial health, including working capital and operating cash flow.

Understanding this distinction helps you plan smarter, avoid surprises, and make better decisions for your business. With proper cash flow management, you can ensure that your profitable business also has enough cash to keep operations running smoothly and grow steadily.

Read Also: Smart Tips for Small Business Branding Success

Common Cash Flow Challenges Faced by Small Businesses

Many small business owners struggle with cash flow management because money doesn’t always move in a smooth, predictable way. Understanding the common challenges can help you prepare and avoid surprises.

One major issue is late client payments. Even if your business is profitable, waiting weeks or months for customer payments can create a cash crunch. This makes it hard to pay bills, salaries, or suppliers on time. Late payments are one of the top reasons small businesses face cash flow problems.

Another challenge is high operating expenses and seasonal fluctuations. For example, retail shops often earn most of their revenue during holidays, but they still have monthly expenses like rent, utilities, and staff salaries. Without careful planning, these peaks and troughs can leave your business short on cash during slow months.

Poor cash flow forecasting and planning is also a common pitfall. Many entrepreneurs focus only on profit and forget to track the movement of money in and out. Without a cash flow statement or proper financial planning, it’s easy to overestimate available funds and run into problems when unexpected expenses arise.

By recognizing these challenges early, you can take action to improve liquidity management and strengthen your financial health. Simple steps like monitoring operating cash flow, creating a realistic forecast, and tracking business finances closely can make a huge difference. With consistent attention to cash flow management, small businesses can navigate tough periods, pay bills on time, and stay on the path to growth.

See Also: 15 Tips for Creating A Business Development Strategy Plan

Simple Cash Flow Management Strategies Every Small Business Should Know

Effective cash flow management doesn’t have to be complicated. Small business owners can take simple, actionable steps to ensure money flows smoothly and operations run without stress.

First, track cash inflows and outflows regularly. Know exactly how much money comes in from sales and how much goes out for bills, salaries, and supplies. This helps you spot problems early and prevents unexpected cash shortages.

Next, create a cash flow forecast. By predicting future income and expenses, you can plan for slow months, seasonal fluctuations, or unexpected costs. A clear cash flow statement makes it easier to make informed decisions and maintain healthy working capital.

Another key strategy is to manage expenses carefully. Delay non-essential payments whenever possible, negotiate with suppliers, and cut unnecessary costs. Even small changes in expense tracking can have a big impact on your financial health.

Finally, leverage technology. Accounting software and cash flow management tools simplify tracking, reporting, and forecasting. These tools provide real-time insights into your operating cash flow, making it easier to plan, adjust, and grow your business confidently.

By consistently applying these strategies, small business owners can take control of their finances, avoid surprises, and make smarter decisions. Remember, mastering cash flow management is not just about keeping the business afloat—it’s about creating a strong foundation for growth and long-term success. Start today, and you’ll see how clarity in cash flow leads to both stability and opportunity for your business.

How to Improve Profit Without Hurting Cash Flow

Many small business owners worry that increasing profit will hurt cash flow, but the two can grow together if managed carefully. Understanding the link between them is key to strong cash flow management and long-term financial health.

One way to boost profit is to increase sales efficiently. Focus on products or services with higher margins, upsell to existing customers, and attract repeat buyers. Efficient sales growth brings in more money without unnecessarily straining your operating cash flow.

Next, reduce unnecessary costs without affecting daily operations. Look at subscriptions, utilities, or supplier contracts and cut what isn’t essential. Small adjustments in expense tracking can significantly improve profit while keeping cash available for essential payments.

Another crucial strategy is to optimize inventory management. Excess stock ties up cash, while too little inventory can slow sales. By monitoring inventory levels closely and using tools for financial planning, you can maintain a balance that supports both profit and liquidity.

Remember, improving profit doesn’t mean spending more money upfront or risking cash shortages. With careful planning, efficient sales, smart cost management, and proper inventory control, you can grow your business sustainably.

By implementing these strategies, you strengthen both profit and cash flow, ensuring your small business thrives. Mastering this balance allows you to make confident financial decisions, seize growth opportunities, and maintain healthy business finances. Start applying these tips today and watch how proper cash flow management helps your profits soar without creating financial stress.

Key Metrics and Tools for Effective Cash Flow Management

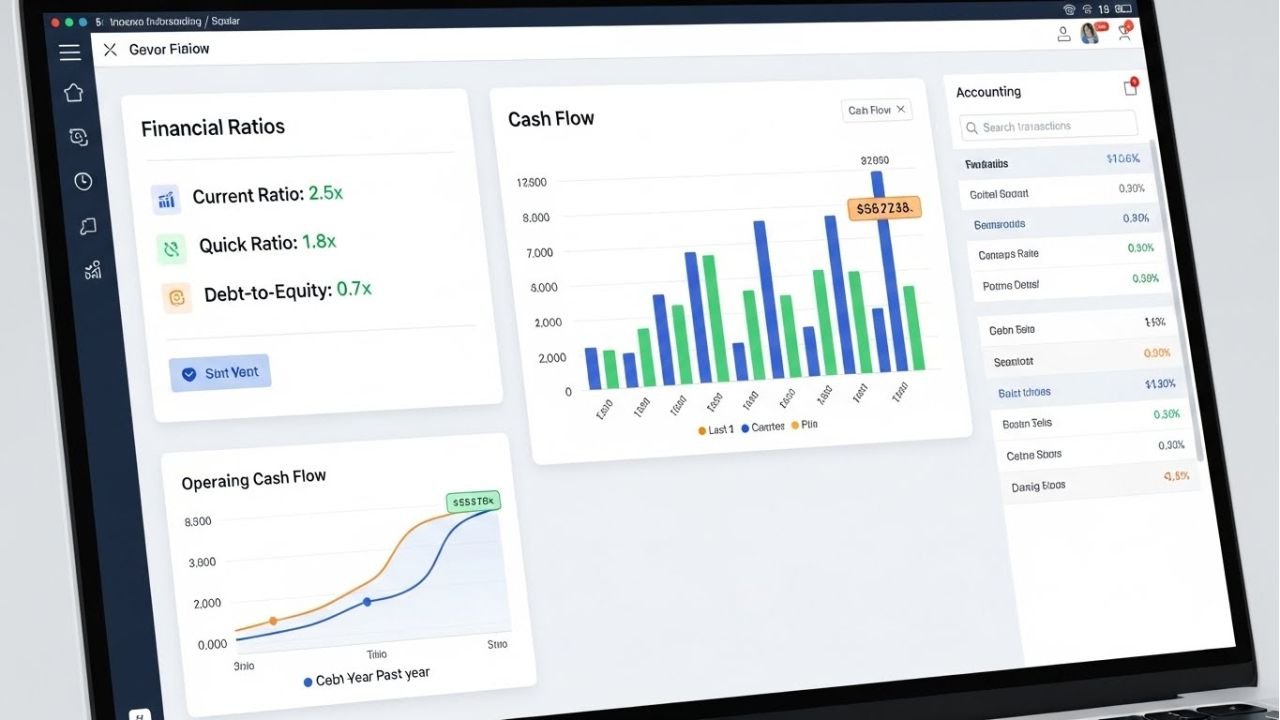

Monitoring cash flow is essential for keeping your small business financially healthy. The first step is understanding your cash flow statement. This simple document shows money coming in and going out of your business. It highlights your operating cash flow, helps track business finances, and identifies areas where adjustments are needed.

Next, focus on key financial ratios that provide measurable insights. The current ratio compares your assets to liabilities, showing if you can cover short-term obligations. The quick ratio measures liquidity by excluding inventory, giving a clear picture of available cash. Finally, the operating cash flow ratio shows how well your daily operations generate cash, helping you spot potential cash flow problems early. Tracking these ratios regularly improves cash flow management and ensures your business stays on solid ground.

Technology can make this process much easier. There are many software and apps designed for small business finance management. Tools like QuickBooks, Xero, and FreshBooks allow you to automate tracking, generate cash flow statements, and forecast future inflows and outflows. With these tools, you can visualize your working capital, monitor trends, and make informed decisions quickly.

By combining accurate metrics with the right technology, you gain complete control over your cash flow. This approach not only prevents surprises but also supports smart financial planning and sustainable growth. Remember, mastering cash flow management is about knowing exactly where your money is, how it moves, and how to use it effectively to strengthen your business.

The Role of Financial Planning in Balancing Cash Flow and Profit

Strategic financial planning is essential for keeping your small business both profitable and cash-rich. It helps you manage cash flow effectively while ensuring steady growth.

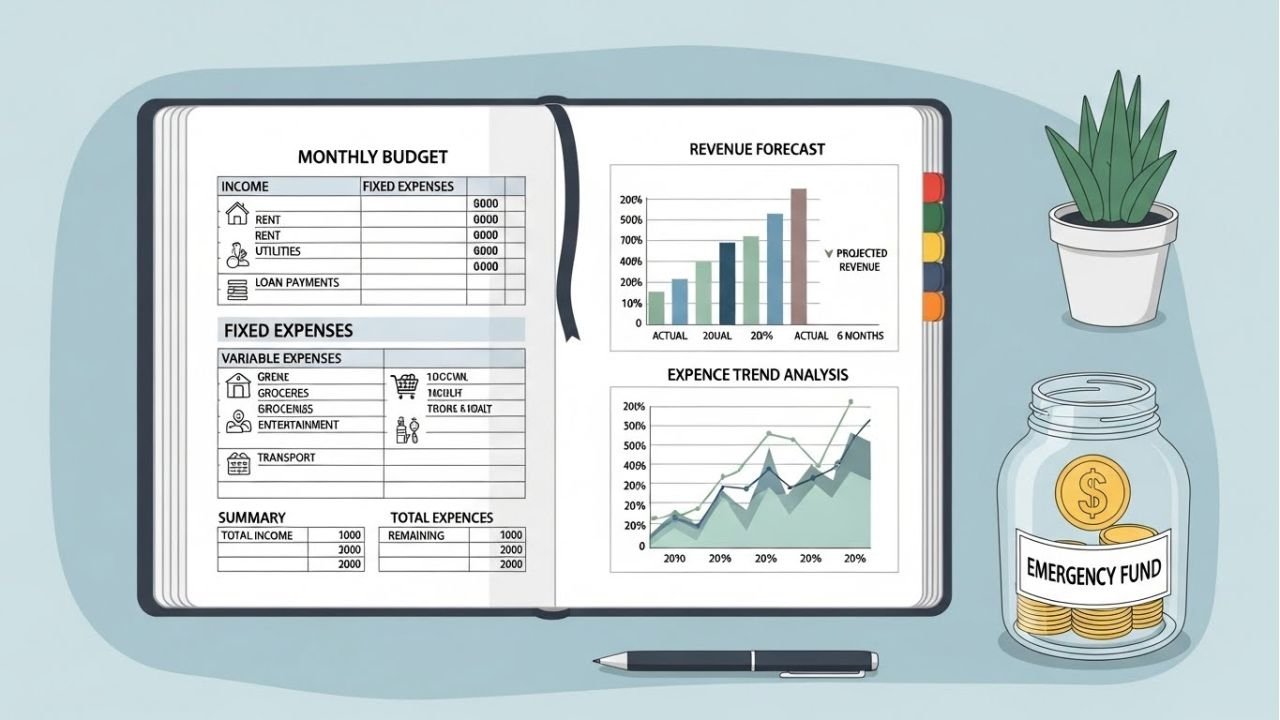

One of the first steps is budgeting and forecasting. By estimating income and expenses, you can see how much cash will be available each month. This practice makes cash flow management easier and prevents surprises that can disrupt operations.

Next, plan for seasonal fluctuations. Many small businesses earn more during certain months and less in others. By anticipating these changes, you can adjust spending, save for slow periods, and maintain smooth operations without straining working capital.

Another key strategy is setting aside emergency funds. Unexpected expenses, like equipment repairs or sudden supply costs, can hurt cash flow if you aren’t prepared. A dedicated fund ensures you can handle surprises without affecting profit or daily operations.

Effective financial planning also involves regularly reviewing cash flow statements, monitoring operating cash flow, and adjusting strategies as needed. Using these insights, you can make smarter decisions about investments, debt, and growth opportunities.

By combining budgeting, forecasting, and careful preparation, small business owners can balance profit and cash flow, improve liquidity management, and secure long-term success. Remember, mastering cash flow management through thoughtful financial planning is not just about surviving—it’s about thriving and growing your business with confidence.

Real-Life Small Business Examples of Cash Flow vs. Profit Challenges

Sometimes, even profitable businesses can run into cash flow problems. Take the example of a small marketing agency. On paper, it was making a good net profit every month, but many clients paid invoices late. This meant the agency didn’t always have enough money to cover salaries, software subscriptions, or office rent on time. Despite being profitable, the business faced stressful cash shortages.

This is a common scenario in small businesses. Cash flow management is what keeps the operations smooth when income timing doesn’t match expenses. In this agency’s case, the owner realized the importance of tracking operating cash flow and monitoring working capital closely.

To solve the issue, the agency implemented a few strategies. First, it created a cash flow forecast to anticipate gaps between incoming payments and outgoing expenses. Next, it negotiated better payment terms with clients and prioritized collecting overdue invoices. Finally, the business started using accounting software to automate tracking and generate clear cash flow statements.

Within a few months, these steps transformed the business. It now had enough cash to pay employees, cover monthly costs, and invest in growth opportunities without relying solely on profit on paper.

This real-life example shows that understanding the difference between profit and cash flow is essential. By mastering cash flow management, small business owners can prevent crises, make smarter decisions, and ensure their business remains healthy and ready to grow.

Master Your Cash Flow and Profit for Business Success

Balancing cash flow and profit is not just a smart business move—it’s the key to keeping your small business healthy and growing. When you understand the difference and actively manage your cash flow, you avoid surprises like missed bills, delayed salaries, or inventory shortages. Proactive cash flow management lets you track money in and out, forecast future needs, and make smarter decisions that keep your business running smoothly.

Remember, even if your business shows profit on paper, poor cash flow can create stress and limit your growth. By combining careful expense tracking, monitoring your cash flow statement, and planning for slow months, you can improve your liquidity management and strengthen your financial health. These steps make it easier to invest in opportunities, pay your team on time, and grow with confidence.

The best part? You can start today. Implement simple strategies like creating a cash flow forecast, tracking daily income and expenses, and separating personal and business finances. By doing this, you take control of your working capital and ensure your business thrives even during tough times.

Don’t wait—start tracking your cash flow today and see the difference it makes. For more practical tips, updates, and expert advice on small business accounting and financial planning, subscribe to our social profiles and stay ahead of the game. Your business deserves a future where both cash flow and profit work together to help you succeed.